AI Business Strategy | 2025

From “Flight Risk” to $2B+ Meta Acquisition

Xiao Hong’s Masterclass for Chinese AI Founders

By Mr. Guo · Reading Time: 10 Min

A Quick Note

Happy New Year! Today marks the first day of 2026.

At the end of 2025, a landmark acquisition shook the global AI landscape. Meta officially announced the acquisition of Manus (the general-purpose Agent platform) and its parent company Butterfly Effect. According to multiple authoritative sources, the deal is valued between $2 billion and $3 billion.

This news sent shockwaves through China’s developer community. On one hand, the deal size alone — in the tens of billions of RMB — is staggering. On the other hand, there’s the founder: Xiao Hong.

Just months ago, Xiao Hong and Manus were drowning in controversy, facing accusations of being a “wrapper,” “vaporware fundraising,” and even “fleeing to Singapore.” Yet today, through this deal, he’s completed a remarkable transformation — not only selling a Chinese-founded company to a Silicon Valley giant but also becoming Meta’s new VP.

Setting emotions aside, from a pure business strategy perspective, this is an invaluable survival and breakthrough case study in today’s complex geopolitical environment. Xiao Hong’s path demonstrates: In deep tech entrepreneurship, technical capability is the foundation, but understanding international rules and designing the right corporate structure often determines a company’s ultimate ceiling. Also, let’s be honest — he’s incredibly good at generating buzz! In my view, a brilliant product manager is likely brilliant but not necessarily great. But when a brilliant product manager also masters growth hacking, the probability of greatness increases exponentially. Elon Musk is another perfect example.

01: Strategic Restructuring — “Identity Isolation” Under Global Architecture

Looking back at Manus’s journey, the early controversy and later successful exit are essentially two sides of the same coin: the “identity dilemma” and “strategic solution” that companies face during globalization.

Domestic critics questioned the “team exodus to Singapore,” but from a business logic standpoint, this was actually risk isolation (de-risking) in response to the unique market environment of 2024-2025:

1. Valuation System Differences: In today’s capital environment, the same technology product valued as a “pure Chinese company” versus a “Silicon Valley/Singapore company” follows completely different valuation logic and exit paths. The former struggles to get premium valuations from USD funds and faces near-impossible NASDAQ listings or acquisitions by US tech giants.

2. Data Compliance and Trust Costs: Manus’s core business is General Agent technology that needs to take over user browser operations and read page data. If data storage or operational entities are in “non-trusted” regions, gaining trust from mainstream Western users becomes extremely difficult, let alone passing compliance reviews from tech giants.

Therefore, Xiao Hong adopted a thorough global architecture strategy:

- Entity Migration: Headquarters moved to Singapore, registered as Butterfly Effect Pte. Ltd., legally severing geopolitical risk.

- Capital Endorsement: Brought in top Silicon Valley VC Benchmark (early investors in Uber and WeWork) to lead a multi-million dollar round. Benchmark’s involvement essentially served as Manus’s “passport” into Silicon Valley’s inner circle, laying the credibility foundation for the eventual acquisition.

This wasn’t simple “fleeing” — it was a top-level structural reorganization to break through the ceiling. Without this complete separation, Manus would never have reached today’s $2B+ acquisition.

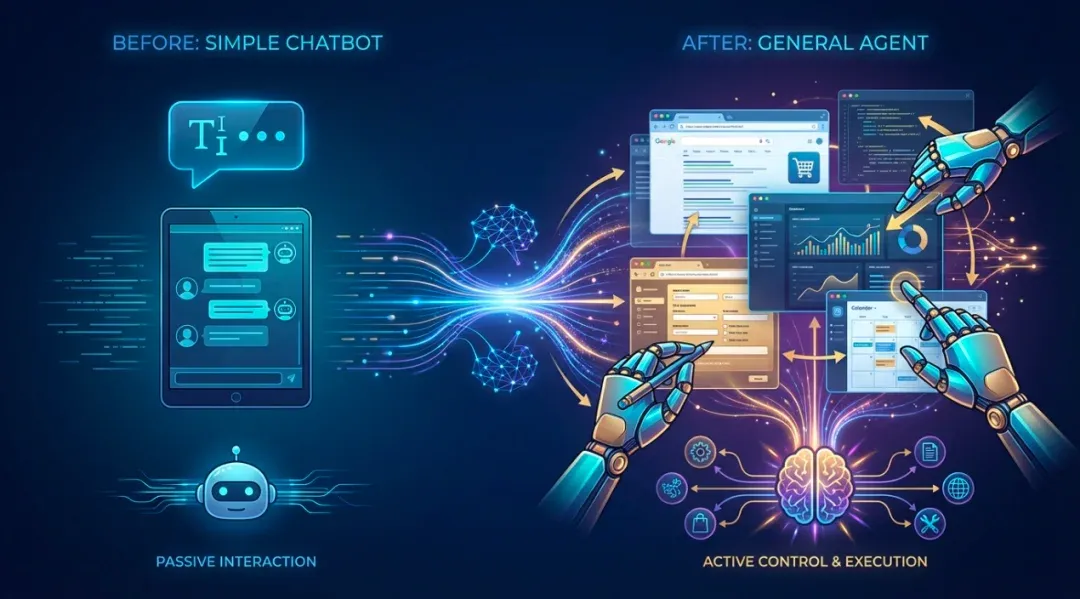

02: Product Positioning — From Chatbot to General Agent

Beyond capital maneuvering, Manus showed exceptional foresight in technology choices.

While the industry focused on Chatbots or Copilots, Manus chose the more difficult path with uncertain commercialization: General Agent.

From “Conversation” to “Execution” — AI Capability Paradigm Shift

Why would Meta pay such a premium for Manus? The core logic lies in ecosystem complementarity:

- Meta’s Strength is the Model Layer: The Llama series of open-source models already have powerful reasoning capabilities (the brain).

- Meta’s Weakness is the Action Layer: They lack a system-level entry point that can directly control interfaces and complete complex tasks (the hands).

Manus’s value lies in building a sophisticated environment interaction system. It doesn’t just generate text — it can operate browsers like a human, completing long-chain tasks like booking tickets, filling forms, and deploying servers.

Xiao Hong bet on the decline of graphical user interfaces (GUI). The future internet entry point will shift from “App interaction” to “Agent interaction.”

This bet on the next-generation interaction paradigm is the key product factor that won over the tech giant.

03: Industry Insights — New Logic for Chinese Developers Going Global

The Meta-Manus acquisition offers three crucial insights for Chinese-background indie developers and founders:

Insight 1: Global Entrepreneurship Requires “Native Thinking”

If your target is global markets or USD acquisitions, overseas business alone isn’t enough. You must achieve “globally native” status in equity structure, data storage, and team distribution. Only by solving the “identity problem” can you enter the mainstream competition track of core markets.

Insight 2: The End of the Wrapper Model

Simple API wrapper products have no moat. Manus is valuable because it went deep into the execution layer, solving countless non-standard webpage adaptation and interaction challenges. In an era where giant models grow increasingly powerful, only doing the complex engineering work that giants “can’t cover” or “haven’t touched yet” creates independent value.

Insight 3: Founder Capability Leveling Up

Xiao Hong’s journey proves that top-tier founders need dual capabilities: being both a product manager (defining future interaction paradigms) and a capital strategist (designing optimal deal structures). In the deep waters of deep tech entrepreneurship, mastery of capital trends and international rules is equally important as technical prowess.

04: Conclusion

Xiao Hong and Manus’s endgame represents a dual victory of capital and technology.

Regardless of how critics view the controversies along the way, the $2B+ acquisition fact validates the effectiveness of his strategic choices.

For developers coming after, this sends a clear signal: In the second half of AI, if you want to break through the internal competition, besides polishing code, you need the vision to see globally and the courage to restructure and break through.

Found this business analysis insightful? Give it a 👍 and share it with more founders who need it!

Follow my channel to explore the infinite possibilities of AI, going global, and digital marketing together.

🌌 Vision is often worth more than code.